The US President Donald Trump-led administration has notified that an additional 25% tariff on India’s exports to the US will be effective from August 27. This brings the total tariffs to around 50%, among the highest faced by major countries trading with the US.

The US Department of Homeland Security, in its draft notification, announced that higher duties will be imposed on Indian goods that are “entered for consumption, or withdrawn from warehouse for consumption, on or after 12:01 am Eastern Daylight Time on August 27, 2025.”

CRISIL has noted that the recent hike in US tariffs will significantly impact India’s micro, small, and medium enterprises (MSMEs), which contribute nearly 45% of the country’s total exports. Among the five sectors expected to be affected, gems and jewellery stand out with the highest exposure – around $10 billion worth of exports to the US. While export volumes are likely to contract, the overall revenue impact may be cushioned by rising gold prices and steady domestic demand.

| Sector | Exports as a share of Domestic Production | Exports to The US | Old Tariff | Additional Ad Valorem Duty | Tariff additional of ad valorem Tax | Impact |

| Pharmaceuticals | 32% | 53% | 1.27% | 0.0% | 1.27% | Neutral |

| Apparel | 25% | 33% | 11% | 50.0% | 61% | Unfavourable |

| Gems and Jwellery | 26% | 37% | 0-7% | 50.0% | 50-57% | Unfavourable |

| Auto componenets | 15% | 28% | 0-2% | 50.0% | 50-52% | Marginally Unfavourable |

| chemicals | 40% | 13% | 3.70% | 50.0% | 53.70% | Unfavourable |

| Steel | -5% | -1% | 0% | 50.0% | 50% | Neutral |

| Seafood | 20 | 22% | 7% | 50.0% | 57% | Unfavourable |

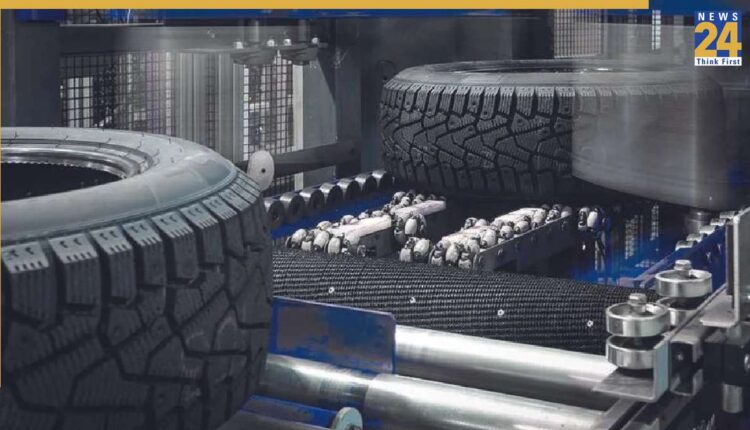

The new changes will disrupt the economics of nearly 27% of India’s auto component exports and 17% of tyre exports. The sweeping tariffs are threatening to erode the competitiveness of India’s $80.2 billion auto component industry. Analysts warn of margin pressures, slower exports, and potential shifts in the supply chain.

The components are covered under Section 232 of the US Trade Expansion Act. Items such as engines, drivetrains, and electrical systems supplied to passenger cars and light trucks will face a uniform 25% duty across all exporting countries. Other parts, including those supplied to the off-highway, construction, and farm equipment segments, will face a 50% tariff.

According to India Ratings and Research (Ind-Ra), while OEM-related contracts may remain shielded in the near term due to longer supply agreements, the replacement markets could feel the pain sooner.

Impact on Tyres and JLR

The tyre sector, where exports to the US constitute 17% of India’s overseas shipments, is especially vulnerable in the replacement market. Tata Motors’ subsidiary Jaguar Land Rover is among the most exposed, with the US accounting for nearly 33% of JLR volumes in the first nine months of FY25 and 23% of revenue in FY24.

The biggest impact will be on India’s gains from the China+1 strategy, which had encouraged global OEMs to diversify away from China. While China too faces high tariffs, its sheer scale and deep supply chains still give it a competitive edge.