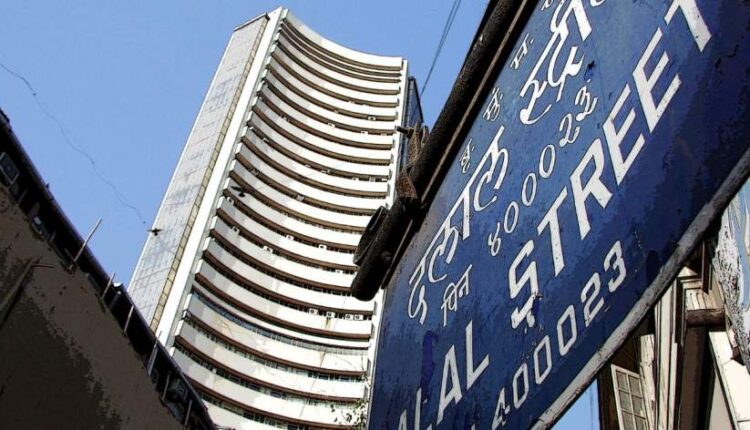

Bloodbath at Dalal Street continues as Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) witnesses massive drop since September 2024. BSE’s Sensex loses more than 10,000 points in just 5 months, whereas NSE’s Nifty loses nearly 4,000 points during this period.

The BSE Sensex Stock Market Index reached an all-time high of almost 86,000 in September 2024, whereas Nifty hit the all-time high of almost 26,300. Meanwhile, Sensex closed at 75,311.06 points, whereas Nifty settled at 22,795.90 points on Friday, February 21.

Bloodbath At Dalal Street: Here Are The Reasons Behind The Drop

- Slow economic growth due to government policies and tariffs.

- Rising inflation concerns, especially among US households.

- Fears of a London Cash Gold contract default, affecting gold prices.

- The US Federal Reserve’s hawkish stance, hinting at no rate cuts.

- Investors moving money from India to China, seeking higher returns.

ALSO READ: Bharti Enterprises Chairman Sunil Bharti Mittal: ‘Ready to roll out satellite telecom services, awaiting Centre’s green nod’

What’s Impacting The Market Now?

- The Indian rupee is continuously witnessing decline. The INR is hitting fresh lows on almost every day.

- US President Donald Trump said that the new 25% tariffs would be imposed on all steel and aluminum imports, in addition to existing duties. This led to the fall of several stocks.

- The recent Delhi election results, which saw the BJP secure a decisive victory, were anticipated to bring stability to market sentiment.

- Union Budget, presented on February 1 and RBI’s MPC decision to cut the repo rate by 25 basis points (bps) to 6.25% failed to impress the equity markets.

Continuous selling by the foreign investors in Indian equities. Foreign investors have pulled out Rs 23,710 crore from Indian equities this month so far.

ALSO READ: Budget Proposals On Agriculture, Fiscal Consolidation Commitment Positive For Price Stability: RBI Policy Minutes

Written By

Akshat Mittal

Feb 22, 2025 12:48